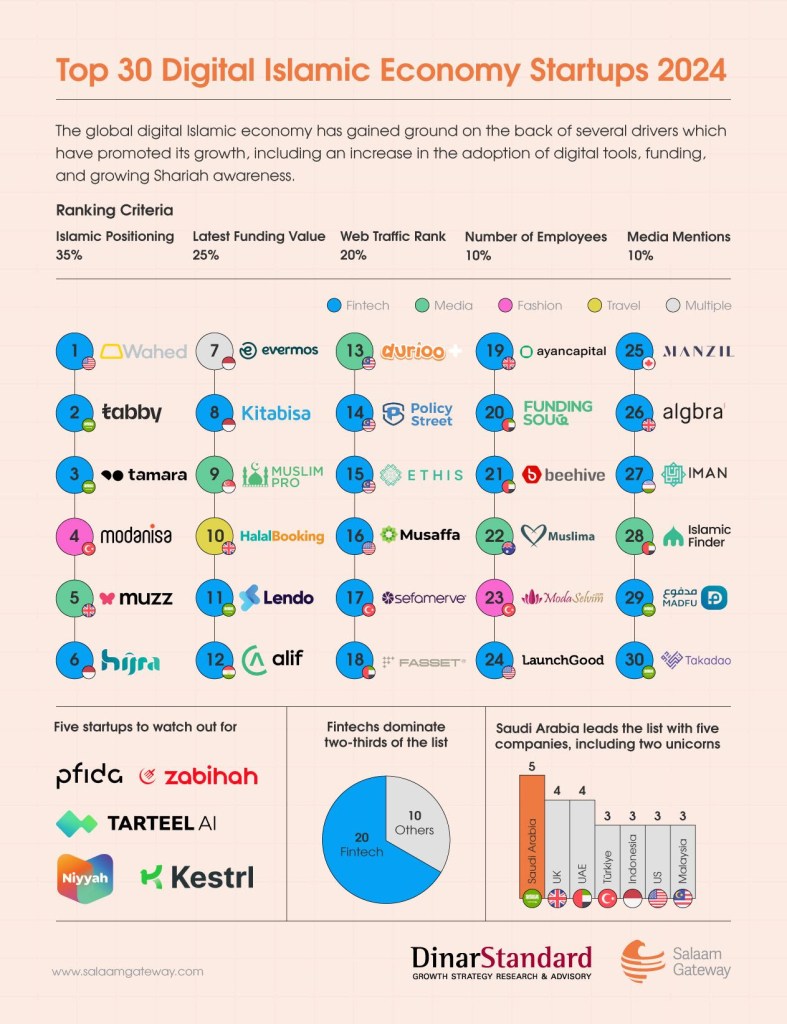

Last month saw the release of the first ever ‘Top 30 Digital Islamic Economy List’ by Salaam Gateway and Dinar Standard.

The list was created to showcase the best in class startups serving the ‘Islamic lifestyle market’.

Naturally, the list created a buzz on social media and rightly so. From startups celebrating well-earned recognition (in most cases, as we’ll come to see!), to people getting a glimpse of the innovation that underpins our future, to consumers wanting to discover new options.

It’s a testament to the power of these lists in capturing public imagination. Which only makes it more disappointing that the list itself falls short.

The problem with the list

As an advocate of Islamic finance who works in the profession and has written about it for the past 3 years, I was genuinely excited when the list was first released.

I was particularly eager to explore the fintech companies that dominated the list (20 out of the 30 startups on the list are fintechs), hoping to discover new entrants and gain insight into how the industry is progressing.

Unfortunately, as I went through the list, I found some surprising and concerning issues.

1. The fact Commodity Murabaha is still a thing in 2024

The first discovery I made was there are still debt-financing companies using controversial structures like commodity murabaha or tawarruq.

For those unfamiliar with commodity murabaha, it is essentially a synthetic loan in practice (I can explain this more in a future post).

Talking about how structures like commodity murabaha work can be quite technically dense so I’ll keep it simple and short for this post.

The simplest explanation I have is commodity murabaha is a way to replicate a loan by buying and selling a commodity at an agreed markup. The individual transactions involved are fine, but together the outcome is the same as a loan.

A real asset is involved, but all the risks associated with holding that asset—like price fluctuations and custody—are so heavily mitigated that it begs the question: why involve the asset at all?

The issues with commodity murabaha are well-known. In fact, Oman has banned its use. Yet, it remains widely used as a ‘placeholder’ in the industry, supposedly until better structures can be developed. Unfortunately, rather than being a last resort, many companies have instead exploited this concession, building products around it as if it’s a legitimate long-term solution.

The use of these structures in 2024 should not be seen as innovative or worthy of praise, let alone worthy of inclusion in an industry-leading list.

It’s time to leave such workarounds in the past.

2. The shocking discovery that some companies have raised money through debt financing

Whilst the use of commodity murabaha was sad but somewhat expected, this next discovery shocked me to the core!

There are startups on the top 30 Islamic list that have raised money through debt financing!

Although I couldn’t verify the exact terms of the loans to determine if they involved interest, the fact that one of the lenders is Goldman Sachs doesn’t inspire confidence.

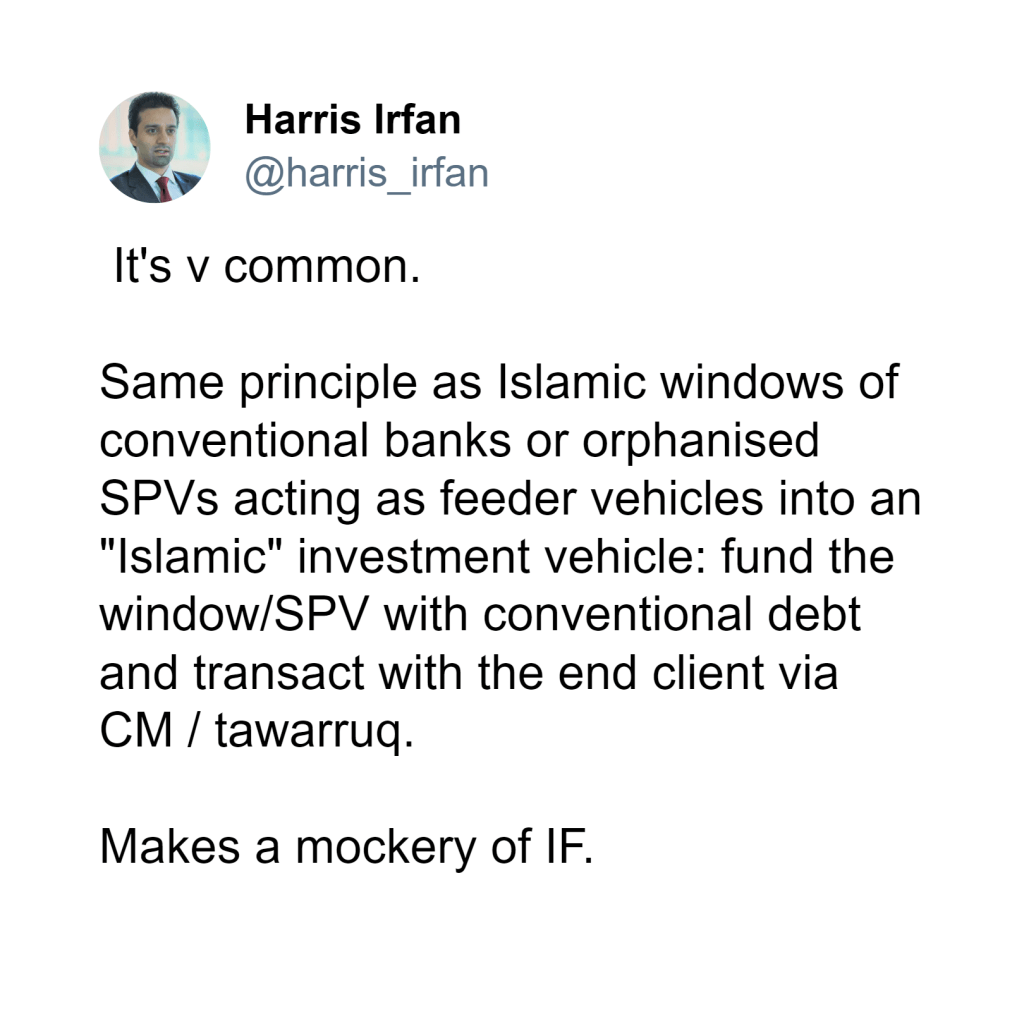

Harris Irfan, CEO of Cordoba Capital Markets and author of Heaven’s Bankers (a fantastic book that I plan to review soon iA), highlighted just how widespread this issue is when I posted about it on X (formerly Twitter).

This is a critical issue that not only undermines the integrity of the Islamic finance industry but also erodes the trust of Muslim consumers—a trust that the industry is still in the process of fully earning.

Personally, I can’t take any company that markets itself as an “Islamic startup” seriously if it raises money through interest-bearing loans (if proven).

This is a massive red flag.

How can Muslims trust that your product or service aligns with their faith when your own financial dealings clearly do not?

The time for better is now

While I’m sure the list was made in good faith and with the best intentions, I sincerely hope that future criteria for ‘Islamic positioning’ will be more robust.

I’m really tired of hearing the argument that “this is just a stepping stone to transition to a better product.” This rationale has been around for decades, and yet, here we are.

Enough is enough—the time for better is now.

I’m not raising these issues to be negative for the sake of it. I’m raising them because we must hold the industry to a high standard to ensure that Muslims have access to the best possible products.

We’ve seen what happens when other groups compromise on their principles. We cannot afford to let the same happen in the Islamic finance space.

One of the ways to hold the line is to help increase overall financial literacy and educate everyday Muslims on how to keep their finances free from haram elements. That’s where I’m focused as a writer—breaking down these complex topics into simple, accessible language to empower our community with knowledge.

If you’re interested in learning more and staying informed, feel free to subscribe via the link below.

Leave a comment